Derivatives serve various purposes in financial markets, including speculation, hedging, and arbitrage. Speculation involves taking on risk with the goal of profiting from anticipated price movements in the underlying asset. For example, a trader may use options to speculate on future stock prices. Hedging aims to mitigate risk from adverse price changes by using derivatives to offset potential losses. A farmer could hedge against falling crop prices by using futures to lock in a selling price. Arbitrage seeks to exploit temporary price discrepancies between assets or markets to lock in risk-free profits.

The value of derivatives comes from their ability to derive value from an underlying asset. This provides leverage, allowing control of a large position with a small initial investment. However, it also introduces risk, as derivatives can magnify potential losses. There are several types of derivatives, each with unique applications:

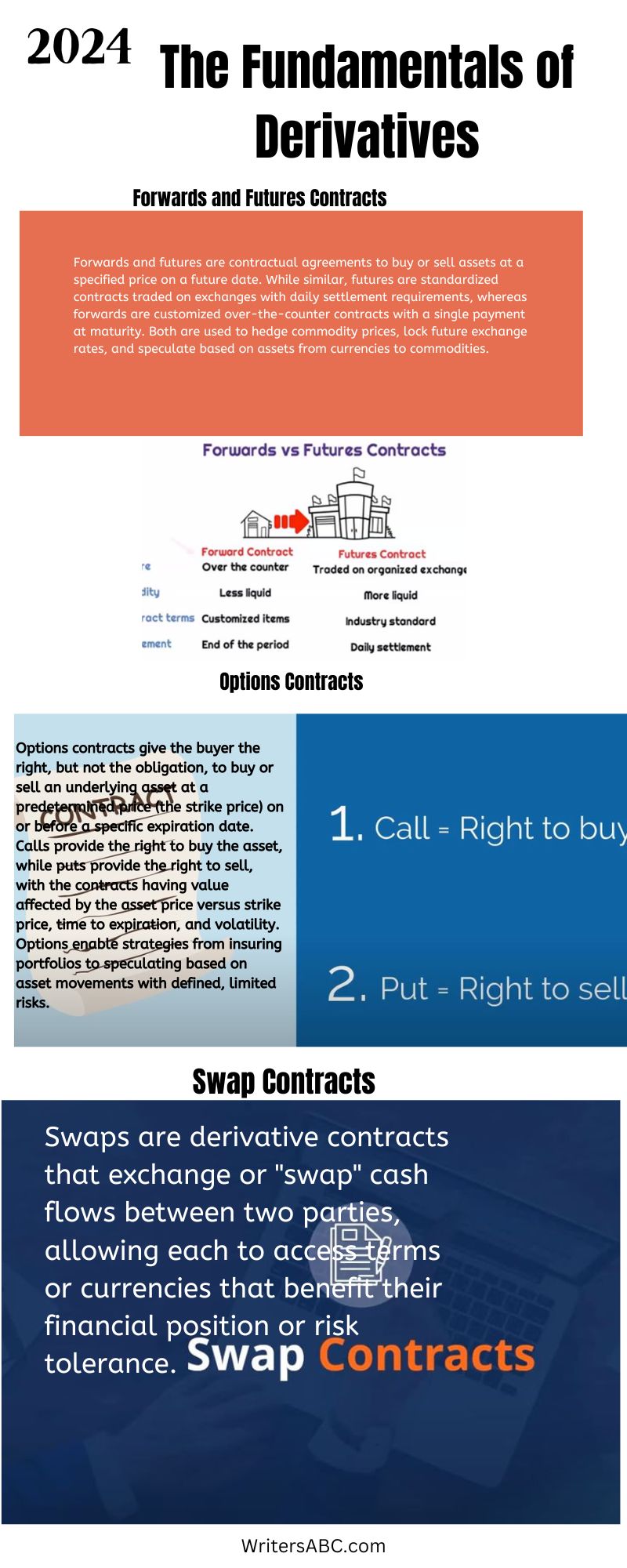

- Forwards are customized contracts between two parties to buy or sell an asset at a set price on a future date.

- Futures are standardized forwards traded on exchanges.

- Options give the buyer the right, but not the obligation, to buy or sell at a preset price within a timeframe.

- Swaps involve exchanging cash flows between parties based on predetermined terms.

“Derivatives – The risk never leaves the system – It finds taker who believes the risk is acceptable….until they lose everything.”

― Economic Warfare: Secrets of Wealth Creation in the Age of Welfare Politics

Forwards and Futures Contracts

Forwards and futures are contractual agreements to buy or sell an asset at a predefined price on a specified future date. Forwards are customized, over-the-counter contracts between two parties that provide flexibility but also counterparty risk. Futures are standardized contracts traded on exchanges that offer transparency and regulation but obligate traders to fulfill the terms.

A key difference lies in their trading structure. Forwards have customizable settlement dates and quantities without an intermediary or clearinghouse. This allows firms to create contracts fitting their specific needs but poses counterparty risk if one side defaults. Futures trade on centralized exchanges like the CME Group, with standardized terms for each contract. While less customizable, exchange trading provides transparency, daily settlement, and clearinghouses to mitigate default risk.

Both instruments enable investors to hedge, speculate, or arbitrage based on the future price movements of commodities, currencies, interest rates, and other underlying assets. Forwards suit customized hedging needs while futures lend themselves to short-term trades by speculators. Forwards also have no upfront payment while futures use margin accounts. While valuable risk management tools, both pose risks like mark-to-market losses if positions sour. Understanding their nuances is key for effective deployment in financial markets.

Options Contracts

Options contracts give buyers the right, but not the obligation, to trade an underlying asset at a preset strike price by the expiration date. Calls allow buying the asset while puts allow selling. The versatile payoff diagrams of options make them useful for speculators, hedgers, and arbitrageurs in financial calculus.

Call payoffs are positive when the underlying price exceeds the strike price at expiry, benefiting from upside potential. Puts pay off when the strike exceeds the underlying price, providing downside protection. Calculus helps determine the optimal strike prices to maximize payoff while minimizing cost. The Black-Scholes formula uses calculus to model option values based on variables like underlying volatility and time to expiry.

Options aid in hedging risk in dynamic investing situations amendable to calculus analysis. Portfolio managers use the Greeks – option sensitivities calculated via differentiation – to hedge options positions using delta hedging and other strategies. Calculus enables statistical pricing of exotic options and modeling optimal early exercise decisions. Overall, options theory extensively utilizes calculus concepts like derivatives, integration, and multivariate equations. Mastering financial calculus unlocks options’ full potential.

“Hedge funds & other money managers sold the equivalent of 391 bcf in the two major futures and options contracts.

“Investors became more bullish about petroleum over the seven days ending on Feb. 13.”https://t.co/gGBImTPNLR#energy #OOTT #oilandgas #WTI #CrudeOil #fintwit… pic.twitter.com/0fGXtd1QKa

— Art Berman (@aeberman12) February 20, 2024

Swap Contracts

Swap contracts are bilateral agreements that exchange cash flows between two parties, providing a flexible tool for managing financial risk. The most common types are interest rate swaps, currency swaps, and credit default swaps.

Interest rate swaps exchange fixed and floating rate interest payments based on a notional principal amount. This allows parties to hedge interest rate risk, alter the characteristics of existing assets/liabilities, or speculate on rate movements. For example,

a company with floating-rate debt may swap to fixed rates to lock in low-interest costs.

Currency swaps exchange principal and interest in different currencies. They reduce currency risk when investing or borrowing abroad. Parties benefit by gaining access to foreign capital markets on better terms. Multinational firms use currency swaps to better match cash flows with costs.

(CDS) involve making periodic payments to a protection seller in return for compensation if a negative credit event like default occurs. CDS provides insurance against default risk on bonds or loans. Speculators can also use CDS to bet on credit quality.

Pricing swaps involve complex modeling of interest rates, currencies, credit spreads, default probabilities, and other variables over the swap’s lifetime. Valuation depends on appraising counterparty credit risk as well. While powerful risk management tools, swaps require sophisticated analytics and carry risks like unforeseen rate/currency fluctuations.

Mechanics of Trading Derivatives

The mechanics of trading derivatives revolve around exchange-traded vs over-the-counter deals, long vs short positions, central clearing, margin requirements, and mark-to-market settlement.

Exchange-traded derivatives like futures and options provide standardization, liquidity, and clearinghouses to guarantee performance. Over-the-counter derivatives like forwards and swaps offer customization between two counterparties but pose counterparty risk.

Investors take long positions when they expect prices to rise by buying contracts, while short positions involve selling contracts to profit from falling prices. Short selling allows speculating on price declines but carries the risk of unlimited losses if prices rise.

Central counterparties and clearinghouses mitigate counterparty risk by standing between the two sides of a derivative contract, acting as the buyer to every seller and vice versa. They also impose margin requirements, mandating upfront collateral to cover potential losses.

Finally, most derivatives use daily mark-to-market settlements where open positions are valued at current market prices. Gains and losses are settled upfront rather than at expiration. Understanding these key mechanics allows informed participation in the complex derivatives markets.

Valuation and Risk Management

Proper valuation and risk management are crucial in derivative trading. Models like Black-Scholes and binomial trees help price options and futures using variables such as underlying prices, volatility, interest rates, and time to expiry. These valuations inform trading decisions and hedging strategies. However, derivatives carry market, credit, liquidity, and operational risks requiring measurement and mitigation.

Statistics like value-at-risk (VaR) quantify potential losses under normal and extreme market conditions. Stress testing simulates crises to gauge exposure. Firms manage risks through strategies like delta-hedging options books, placing stop-loss orders, and maintaining diversified portfolios.

Regulations like Dodd-Frank and Basel III also govern derivative trading, imposing capital, margin, reporting, and transparency rules. For example, Basel III increased capital charges on counterparty credit exposures. Margin rules mandate collateral deposits. Clearinghouses help mitigate counterparty risk. Adhering to regulations while implementing internal controls and risk management best practices promotes stability in often volatile derivative markets.

Get Customized Derivatives Help from Calculus Experts Today

Derivatives like forwards, futures, options, and swaps are versatile financial tools. They allow parties to transfer risk, speculate on asset prices, and exploit arbitrage opportunities. Mastering their strategic use requires understanding key fundamentals.

This overview covers core definitions, purposes, risks, and mechanics of major derivative types. A deep grasp of pricing models involving calculus is vital for valuation and risk management. Connecting with calculus experts can provide guidance on using options theory and Greeks for effective hedging.

Navigating the complexities of derivatives requires comprehending factors impacting their value and volatility. Examples include interest rates, counterparty risk, time decay, and regulations. Applying robust risk management practices is essential for long-term success.

Options theory and pricing models like Black-Scholes extensively utilize calculus. Students can get calculus assignments help from calculus experts to better understand derivatives pricing and Greeks for effective hedging.

Understanding derivative pricing models, risk metrics, and regulations is crucial for effective valuation and risk management. Factors like volatility, interest rates, time decay, and counterparty risk all impact derivative values and risks. Appropriate regulations enhance transparency and stability in often volatile derivative markets.

A solid grounding in derivatives fundamentals empowers investors to unlock their potential while avoiding pitfalls. For help mastering any aspect of derivatives education covered here, visit WritersABC to connect with expert calculus tutors to help you handle your calculus assignments.

The Fundamentals of Derivatives Explained in 2024